Understanding KYC Regulations in Korea

Understanding KYC regulations in Korea is essential for travelers and businesses alike, as these regulations are designed to ensure the security and integrity of financial transactions and personal identification processes, thereby fostering a safe and trustworthy environment for both domestic and international interactions. In Korea, the Know Your Customer (KYC) framework is meticulously structured to prevent fraudulent activities, money laundering, and other financial crimes, which necessitates that individuals and businesses provide accurate and verifiable identification information when engaging in various transactions. The Korean government has implemented these regulations to align with global standards, ensuring that financial institutions and service providers adhere to strict protocols that verify the identity of their customers, thus promoting transparency and accountability in all financial dealings. By understanding these regulations, travelers and eSIM users can better navigate the requirements for identification verification, which is crucial for accessing services that require stringent compliance, such as opening bank accounts, purchasing mobile services, or engaging in other financial activities. As such, being aware of and complying with KYC regulations not only facilitates smoother transactions but also contributes to the broader goal of maintaining a secure and efficient financial ecosystem in Korea, which is beneficial for all parties involved.

Types of Identification Accepted in Korea

When traveling to Korea and utilizing services such as acquiring an eSIM, understanding the types of identification accepted is crucial for a seamless experience, as the country has specific requirements that travelers must adhere to for successful KYC verification. In Korea, the types of identification accepted typically include a valid passport, which serves as the primary document for international visitors, ensuring that they can prove their identity and nationality without any complications. Additionally, for those who may have resident status or are staying for an extended period, a foreigner registration card or a Korean driver’s license may also be accepted, providing flexibility and accommodating different types of visitors. It is important for travelers to ensure that their identification documents are up-to-date and valid for the duration of their stay, as expired or invalid identification can lead to unnecessary delays or complications in completing KYC processes. By being prepared with the correct identification and understanding the requirements, travelers can ensure a smooth process when accessing services that require identity verification, ultimately enhancing their overall experience in Korea.

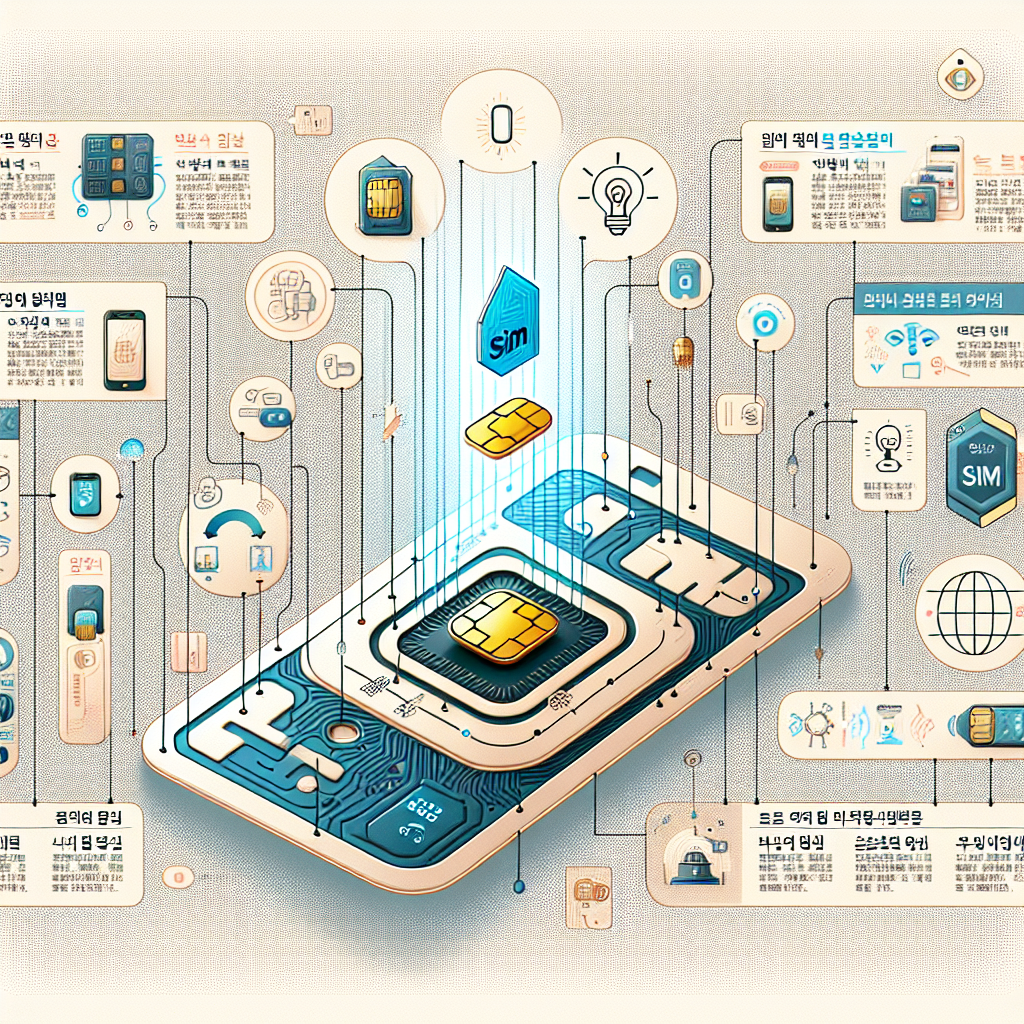

Steps to Complete KYC Verification in Korea

When embarking on the process of KYC verification in Korea, it is essential to understand the procedural steps involved, as this ensures compliance with local regulations, which are designed to protect both consumers and service providers in a rapidly evolving digital landscape. Initially, travelers and eSIM users should gather all necessary identification documents, which typically include a valid passport and, in some cases, additional forms of identification such as a driver’s license or an international ID card, to ensure a smooth verification process. Once the identification documents are ready, users must submit them through the designated channels provided by their service provider, which may involve online platforms or in-person verification centers, depending on the provider’s specific requirements and the nature of the services being accessed. It is important to follow the instructions carefully and provide accurate information, as any discrepancies or errors can lead to delays or complications in the verification process, which may ultimately impact the ability to use certain services or access financial transactions. By understanding these steps and preparing accordingly, travelers can ensure a seamless experience while complying with Korea’s KYC regulations, thereby enhancing their overall travel experience and ensuring access to a wide range of digital services.

Challenges and Solutions for KYC Compliance in Korea

In the context of KYC compliance in Korea, travelers and businesses alike often encounter a range of challenges that can complicate the process of identity verification, primarily due to the stringent regulatory environment and the necessity for precise adherence to local requirements, which can be particularly daunting for those unfamiliar with the intricacies of Korean legal and financial systems. One significant challenge is the language barrier, as many of the official documents and communications are predominantly in Korean, necessitating either a proficient understanding of the language or the use of translation services, which can introduce delays and potential errors. Additionally, the rapid pace of technological advancements in Korea, while beneficial in many respects, can pose difficulties for those attempting to keep their systems up to date with the latest security protocols and digital identification methods, often requiring substantial investment in both time and resources. However, solutions to these challenges are increasingly accessible, as many service providers are now offering more comprehensive support, including multilingual assistance and user-friendly platforms designed to simplify the KYC process for international users. By leveraging these resources and maintaining an awareness of ongoing regulatory changes, travelers and businesses can navigate the complexities of KYC compliance more effectively, ensuring a smoother experience in Korea.

Impact of KYC on Financial Transactions in Korea

The implementation of Know Your Customer (KYC) regulations has significantly influenced financial transactions in Korea by enhancing security measures and fostering trust between financial institutions and their clients, as it requires customers to provide valid identification and pertinent personal information, which helps to prevent fraudulent activities and money laundering. This regulatory framework not only ensures that financial institutions are better equipped to understand the financial behaviors and backgrounds of their clients, but it also aids in the creation of a safer financial environment, ultimately contributing to the stability of the Korean financial system. Additionally, KYC regulations have prompted financial institutions to invest in advanced technologies and systems that streamline the verification process, thereby improving efficiency and customer experience, although it has also led to increased operational costs for these institutions. Despite the challenges posed by KYC compliance, such as the complexity of managing vast amounts of data and ensuring privacy protection, the overall impact on financial transactions in Korea has been largely positive, as it has bolstered the integrity of financial operations and reinforced the country’s commitment to upholding international standards in financial security and transparency.

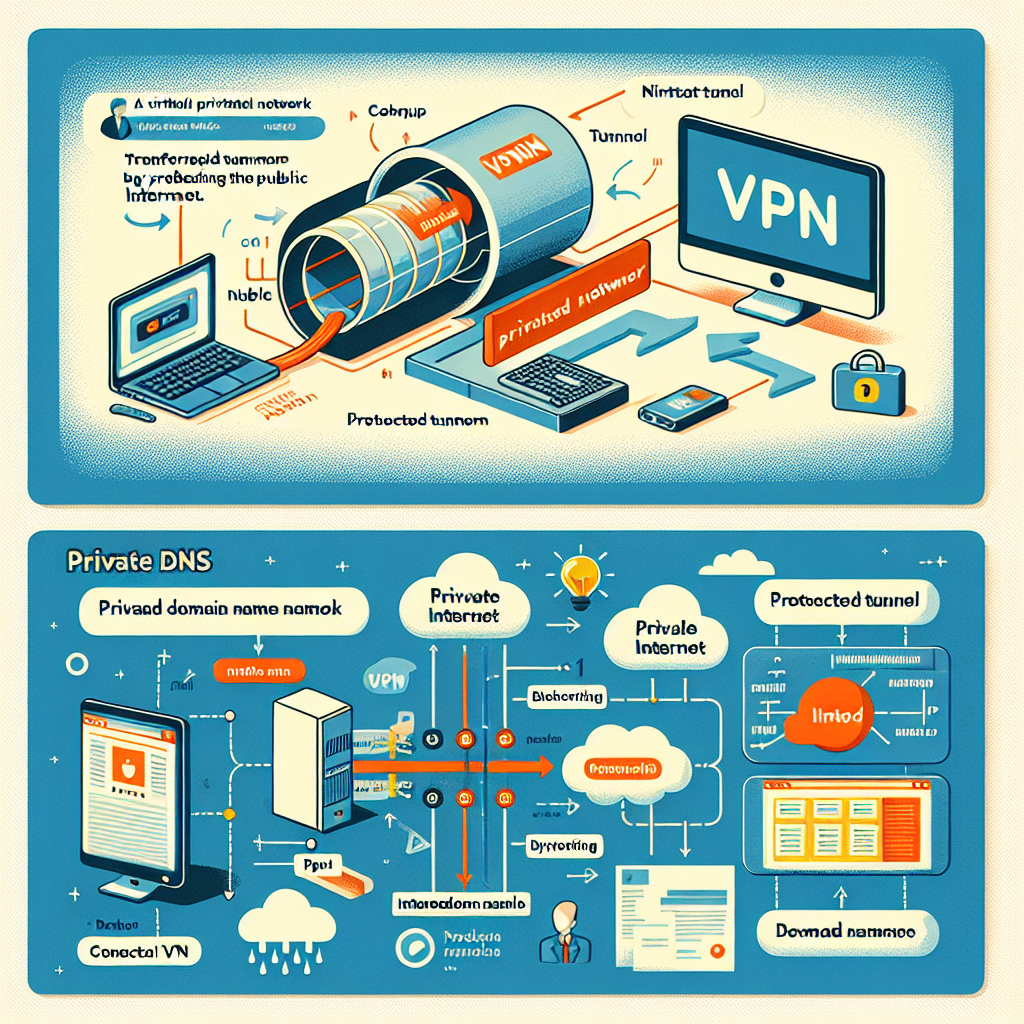

Future Trends in KYC and ID Verification in Korea

As we look to the future of KYC and ID verification in Korea, it is evident that technological advancements and regulatory changes will play pivotal roles in shaping how these processes evolve, with a strong emphasis on enhancing security, efficiency, and user experience. The integration of artificial intelligence and machine learning into KYC procedures is expected to streamline verification processes, allowing for real-time analysis of data, which will not only reduce the time required for verification but also minimize the risk of human error and fraudulent activities. Additionally, the growing adoption of blockchain technology is anticipated to revolutionize the way personal data is stored and shared, offering a more secure and transparent method for managing sensitive information, thereby fostering greater trust among users and service providers alike. As Korea continues to embrace digital transformation, regulatory bodies are likely to update and refine guidelines to keep pace with these innovations, ensuring that KYC and ID verification processes remain robust and compliant with international standards, ultimately facilitating smoother financial transactions and enhancing customer satisfaction.