UnderstandingtheBasicsofJapaneseQRPaymentSystems

Understanding the Basics of Japanese QR Payment Systems

Japanese QR payment systems have gained significant popularity in recent years, offering a convenient and efficient way to conduct transactions. These systems allow users to make payments by scanning QR codes with their smartphones, eliminating the need for cash or physical cards. To understand how these systems work, it is essential to grasp a few key concepts.

Firstly, you should know that QR payment systems in Japan are supported by various service providers such as PayPay, Line Pay, and Rakuten Pay. Each of these services has its own app that you can download on your smartphone. These apps facilitate the scanning of QR codes and manage your transactions securely.

To use a QR payment system, you must first set up an account with one of these service providers. This typically involves downloading the app and registering your details, including linking your bank account or credit card to enable seamless transactions. Once your account is set up, you can add funds directly through bank transfers or credit card top-ups.

When making a purchase at a store that accepts QR payments, simply open the app on your smartphone and scan the merchant’s displayed QR code. The app will then prompt you to confirm the transaction amount before processing it securely through encrypted channels.

It is important to note that many Japanese retailers now accept multiple forms of digital payments due to their convenience and speed. However, not all stores may support every type of QR payment service available in Japan. Therefore, it’s advisable to check which services are accepted before attempting a transaction.

Security is a priority for Japanese QR payment systems; they employ encryption protocols and authentication processes to protect users’ financial information during transactions. As long as you follow basic security practices like keeping your phone secure with passwords or biometric locks and being cautious about where you scan codes from, using these services can be both safe and efficient.

In summary, understanding Japanese QR payment systems involves familiarizing yourself with different service providers’ apps available in Japan while ensuring secure setup procedures for smooth transactions at participating retailers. With this knowledge in hand, you’ll be well-equipped to navigate Japan’s growing cashless economy efficiently!

SettingUpYourAccountforQRPaymentsinJapan

Setting up your account for QR payments in Japan can seem daunting at first, but by following a few straightforward steps, you will be ready to make seamless transactions. First and foremost, you need to choose a QR payment service that suits your needs. Popular options include PayPay, LINE Pay, and Rakuten Pay. Each of these services has its own unique features and benefits, so it is important to select one that aligns with your preferences.

Once you have chosen a service, download the corresponding app from the App Store or Google Play Store. After installing the app on your smartphone with an eSIM capability, open it and follow the on-screen instructions to create an account. Typically, you will need to provide some basic personal information such as your name, phone number linked with eSIM technology for verification purposes.

Next, you will likely be asked to verify your identity. This process may involve uploading a photo of a government-issued ID or confirming a code sent via SMS or email. The verification step is crucial as it ensures the security of your transactions.

After verifying your identity, set up a secure password for your account. It is advisable to use a combination of letters, numbers, and symbols to enhance security.

The next step involves linking a funding source such as a bank account or credit card to enable transactions through the QR payment service. You may need online banking details or card information during this process.

Finally, once everything is set up and verified successfully within the app using eSIM data connection if necessary while traveling in Japan without Wi-Fi access points readily available everywhere; test out making small payments at participating merchants before relying heavily on this method in daily life situations just yet until comfortable navigating different scenarios encountered along way ahead!

ChoosingtheRightQRPaymentAppforYourNeeds

Choosing the right QR payment app for your needs in Japan can greatly enhance your convenience and efficiency while making transactions. With a variety of options available, it is important to consider several factors to ensure you select the most suitable app.

Firstly, you should assess the compatibility of the QR payment app with your smartphone and operating system. Most apps are available for both iOS and Android devices, but it is always wise to confirm this before proceeding. Additionally, check if the app supports eSIM technology, as this can be a crucial factor if you are using an eSIM-enabled device.

Secondly, consider the acceptance rate of the QR payment app at stores and services in Japan. Apps like PayPay, LINE Pay, and Rakuten Pay are widely accepted across numerous retailers and service providers. Choosing an app that is commonly used will ensure that you can make payments seamlessly at various locations.

Another important aspect to evaluate is the security features offered by each app. Look for apps that provide robust security measures such as biometric authentication (fingerprint or facial recognition) and transaction notifications. These features help protect your financial information from unauthorized access.

Furthermore, examine any additional benefits or rewards programs associated with each QR payment app. Some apps offer cashback or loyalty points for every transaction made through their platform. These incentives can add value to your purchases over time.

Lastly, consider user reviews and ratings when selecting a QR payment app. Feedback from other users can provide insights into potential issues or advantages of using a particular service.

By carefully considering these factors—compatibility, acceptance rate, security features, additional benefits, and user feedback—you will be better equipped to choose a QR payment app that meets your specific needs while navigating Japan’s digital economy efficiently.

LinkingYourBankAccounttoaJapaneseQRPaymentService

Certainly! Here is a text on the topic “Linking Your Bank Account to a Japanese QR Payment Service” written in polite English:

—

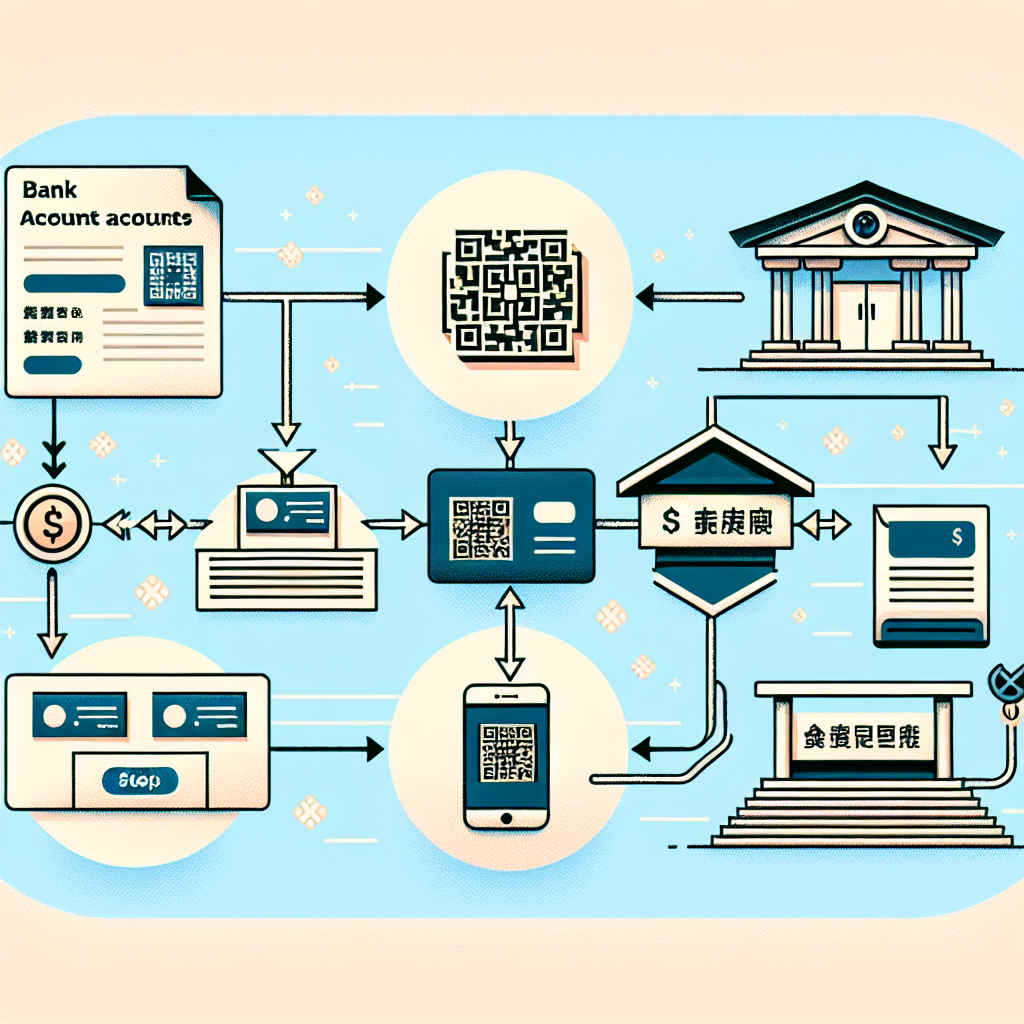

Linking your bank account to a Japanese QR payment service is an essential step for seamless transactions. To begin, please ensure that you have already downloaded and installed the desired QR payment app on your smartphone. Popular options include PayPay, LINE Pay, and Rakuten Pay, each offering unique features and benefits.

First, open the app and navigate to the settings or account management section. You will find an option labeled “Add Bank Account” or something similar. Please select this option to proceed.

Next, you will be prompted to enter your bank details. It is important to have your bank account number and branch code ready. In Japan, these are often referred to as “口座番号” (kouza bangou) for account number and “支店コード” (shiten koudo) for branch code. Once you enter these details accurately, the app may require additional verification steps.

Verification typically involves confirming small deposits made by the service into your bank account or providing identification documents such as a driver’s license or residence card. Please follow the instructions carefully as each service may have slightly different procedures.

After successful verification, your bank account should be linked to the QR payment service. This connection allows you to easily transfer funds from your bank for transactions at various merchants that accept QR payments in Japan.

Please remember that maintaining security is crucial when linking financial information online. Always use strong passwords for both your banking app and QR payment app accounts. Additionally, enabling two-factor authentication adds an extra layer of security.

If any issues arise during this process—such as difficulty verifying your account—please consult the customer support section within the app or contact their helpline directly for assistance.

By following these steps diligently, you can enjoy convenient and efficient cashless transactions across Japan using QR codes linked directly with your bank account.

—

I hope this helps! If you need further information or adjustments, feel free to ask.

MakingSecureTransactionswithJapaneseQRCodes

Certainly! Here’s a passage on “Making Secure Transactions with Japanese QR Codes” written in polite English:

—

When using QR codes for transactions in Japan, it is crucial to ensure that your payments are secure. To begin with, always use reputable QR payment apps that have strong security measures in place. These apps typically offer features such as two-factor authentication and encryption to protect your personal and financial information.

Before making a transaction, please verify the authenticity of the merchant’s QR code. Scammers sometimes create fake codes to divert payments to their accounts. You can do this by checking the merchant’s details within the app or by confirming directly with the store staff.

It is also advisable to keep your smartphone’s operating system and all payment apps updated. Developers regularly release updates that include security patches to safeguard against new threats. By keeping everything up-to-date, you reduce the risk of vulnerabilities being exploited.

Additionally, be mindful of your surroundings when making a payment in public spaces. Ensure that no one is watching over your shoulder as you enter sensitive information or confirm transactions on your device.

For added security, consider setting spending limits within your payment app if it offers such features. This can prevent unauthorized high-value transactions if someone gains access to your account.

In case of any suspicious activity or unauthorized transactions, contact customer support immediately through official channels provided by the app or service provider. They can assist you in resolving issues quickly and may help recover lost funds if applicable.

By taking these precautions and staying informed about best practices for digital payments, you can enjoy the convenience of Japanese QR code systems while keeping your financial information secure.

—

I hope this helps! If you need further assistance or modifications, feel free to ask!

TroubleshootingCommonIssueswithQRPaymentsinJapan

Certainly! Here’s a 600-character English text on the topic “Troubleshooting Common Issues with QR Payments in Japan”:

When using QR payment systems in Japan, you may encounter some common issues. Understanding these problems and their solutions can help ensure smooth transactions.

Firstly, connectivity issues are common. Please ensure your eSIM is properly activated and that you have a stable internet connection. If problems persist, restarting your device often resolves temporary network glitches.

Another issue could be app compatibility. Make sure your QR payment app is updated to the latest version. Developers frequently release updates to fix bugs and improve performance.

If you experience difficulties linking your bank account, double-check that all entered information matches exactly with your bank records. Small discrepancies can prevent successful linkage. Contacting customer support for both the bank and the payment service might be necessary if issues continue.

Security settings on your device could also interfere with transactions. Please verify that permissions for camera access are enabled since scanning QR codes requires it.

Lastly, if a transaction fails at checkout, confirm that there are sufficient funds in your linked account or digital wallet. Sometimes retrying after a few minutes helps as minor server delays might cause temporary disruptions.

By addressing these common issues proactively, you can enjoy seamless experiences with Japanese QR payment services!